When costs are traceable to products and services, they are undeniably product costs. Being traceable means that you won’t have a hard time determining the physical quantity and its cost equivalent. Business often segregates these costs based on fixed, variable, direct, or indirect.

Period Costs Examples: From Advertising to Rent

Managing rent and utility expenses efficiently is crucial for businesses to maintain a healthy cash flow and allocate resources effectively. By monitoring these costs and exploring cost-saving measures, businesses can optimize their spending and improve their overall financial performance. It is important for businesses to carefully track and analyze their advertising and promotion expenses to evaluate their effectiveness.

Period Cost vs Product Expense

The cost of rent can vary depending on factors such as location, size of the office space, and local real estate market conditions. Businesses need to carefully evaluate their space requirements and negotiate income summary favorable lease terms to manage this period cost effectively. Choosing the appropriate method of allocating Period Costs depends on factors such as the nature of the business, the complexity of operations, and the availability of data. By implementing effective cost allocation methods, businesses can gain insights into their cost structure, enhance decision-making capabilities, and ultimately drive sustainable growth and profitability. There is no fixed approach to identifying the period expense in all the particulars.

- Costs and expenses that are capitalized, related to fixed assets, related to purchase of goods, or any other capitalized interest are not period costs.

- Product costs are recognized as expenses when the corresponding products are sold, typically as part of the cost of goods sold.

- Moreover, it helps authorities identify the irrelevant unavoidable costs that will always consider reaching the breakeven point.

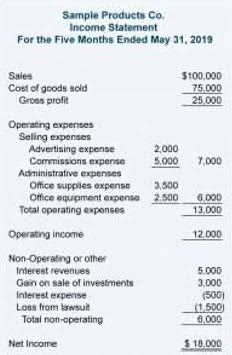

- Rent falls under operating expenses, while product costs like labor and materials are used to calculate COGS.

- By recognizing the impact of period costs on profit, companies can make informed decisions about investing in innovation.

- They are identified with measured time intervals and not with goods or services.

Examples of Product Costs and Period Costs

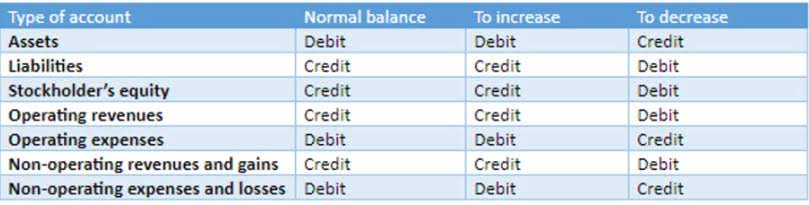

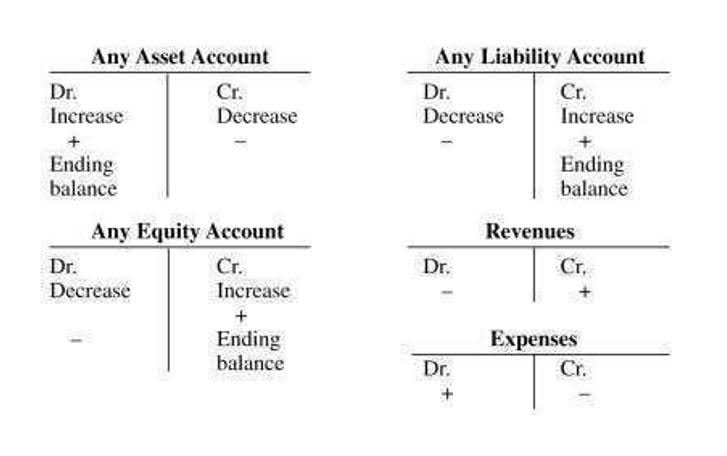

In summary, period costs like rent and advertising are expensed immediately each accounting period on the income statement. Product costs like materials are included in inventory valuation through cost of goods sold when production occurs. Liabilities are normally things that are settled over time through the transfer of money, goods, or services. Liabilities can either be short-term obligations that are due within one year of a normal accounting period, or they can be long-term liabilities and are not due for more than one accounting period.

Since admin employees aren’t directly involved in production, their salaries are period costs. Since they can’t be traced to products and services, we attribute them to the period in which they were incurred. Most period costs are fixed because they don’t vary from one period to another. Let’s discuss the accounting treatment of product costs and period costs in greater detail. Period cost refers to the passage of time incurred by the businesses even if there is no production of goods or inventory period costs purchase. Therefore, a period cost is generally recorded in the books of accounts with inventory assets.

- Period cost analysis also helps in identifying cost drivers within a business.

- If you manufacture a product, these costs would include direct materials and labor along with manufacturing overhead.

- Period costs, also known as operating expenses, are the expenses that are not directly tied to the production of goods or services.

- The treatment of R&D costs as period costs highlights their role in the strategic direction of a business.

- Our rigorous editorial process includes editing for accuracy, recency, and clarity.

Examples of Period Cost Examples

Some examples of what a product costs include, direct labor, raw materials, manufacturing supplies, and overhead that is directly tied to the production facility, such as electricity. Period costs encompass a variety of expenses that are essential for the day-to-day operations of a business but are not part of the manufacturing process. These can be broadly categorized into selling costs and administrative costs. Selling costs relate to the activities that generate sales and include advertising, sales commissions, and promotional materials. Administrative costs pertain to the general management of the business and include executive salaries, legal fees, and other overhead bookkeeping for cleaning business not related to production.

To overcome these challenges, finance professionals should employ robust cost accounting systems, utilize appropriate cost allocation methods, and consider qualitative factors in their analyses. Accounting for both types of expenses is key for profitable pricing strategies. Managers are always on the lookout for ways to reduce costs while trying to improve the overall effectiveness of their operations. However, if these costs become excessive they can add significantly to total expenses and they should be monitored closely so managers can take action to reduce them when possible. The salaries and wages of administrative staff can vary depending on factors such as job roles, experience, and location.